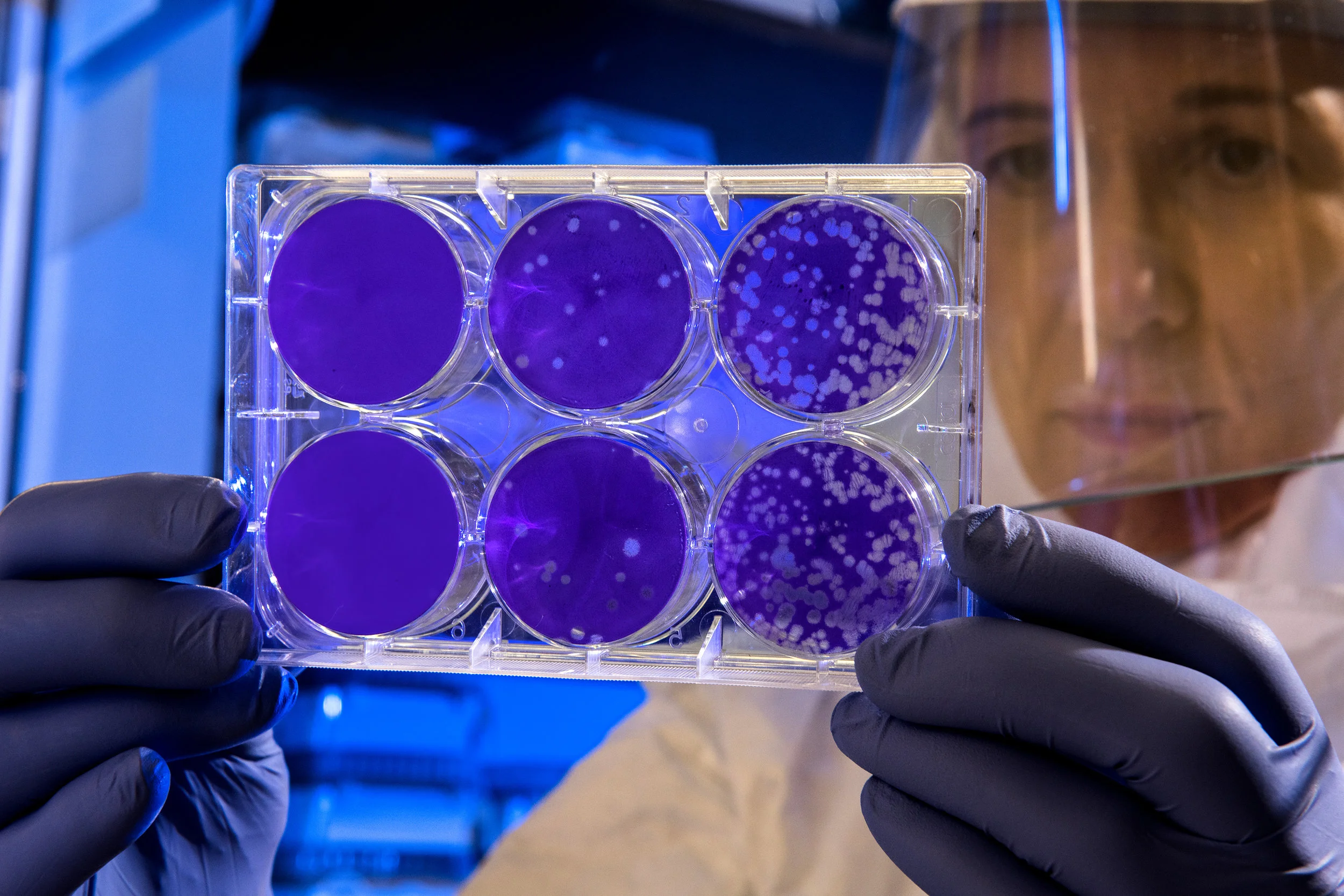

First, we now have enough preliminary data to say some general things about the virus and the news is good: the virus is neither as deadly nor as communicable as the SARS virus from more than 15 years ago. Take a look at this from Dr Melvin Sanicas with the Gates Foundation. (Twitter handle: @Vaccinologist.)

Read MoreNichole is already getting more press than the Boss!

Read MoreWant to know what we think is in store for 2020? Check out what Brian Wesbury has to say about it!

Read MoreThe economic consensus is that the US economy will grow only 1.8% in 2020 (on a Q4/Q4 basis), which would be the weakest growth since 2012. Instead, we're forecasting growth in the 2.5 - 3.0% range. In particular, look for both home building and business investment to contribute more to economic growth next year than they did in 2019, while growth in consumer purchasing power continues to boost spending.

Read MoreOur new promotional video is here and its on the Borough of Haddonfield’s web page too! Let us know what you think!

Read MoreOur Grand Opening was a Huge Hit! Check out the pictures and see what the new office looks and how fun the party was!

Read MoreHaddonfield NJ- After 15 years working in the financial and insurance field, Adam V. Puff knew exactly what he did not like about the industry. Adam decided to do it his way. On Saturday, September 21, he will launch Haddonfield Financial Planning in a bigger space.

Read More"Cryptocurrencies: The Ultimate Safety Valve"

Read MoreThe 99% Get a Bigger Raise!!!

Read MoreFollowing World War 2, many believed that the central planning that won the war was also a framework for economic prosperity. The United Kingdom tried to apply it with coal and steel, while Japan focused on consumer products. The UK strategy was a failure almost from the start, and it took Margaret Thatcher's leadership in the 1980's to get back on the free market path. Japan got lucky, and their growth in the 80's caused many to think that economic theory had been turned on its head. But when the music stopped, Japan's luck was exposed. They couldn't pivot.

Now many think China's communist approach has proven itself a path towards sustained growth, but they are missing the message of history.

Furthermore, if only the US were to go on the gold standard, this move would create a windfall for those countries with large gold reserves and would also put the US money supply at the mercy of Russia, China, and a few other countries who are not our strongest allies at the moment.

Read MoreOops, they did it again!

Just weeks ago, the pouting pundits were predicting near-zero GDP growth in the first quarter.

Instead, last Friday's report showed real growth at a 3.2% annualized rate. And Q2 looks likely to come in above 3% as well.

For the umpteenth time, Conventional Wisdom said the growth was over. The economy – and markets – had reached their peak.

Just because wisdom is conventional, doesn't mean it's correct.

The logic of Alberta leaving Canada is difficult to deny. If the rest of Canada remains hellbent on cramping the Albertans’ style, why not quit the Canada Show? Alberta isn’t dependent on the federal government’s financial handouts like other provinces. It has an energy sector, public infrastructure, educational system and workforce that has drawn plenty of international investment interest on its own. Negotiating export pipelines directly with the United States would be infinitely easier than with other Canadian governments, especially since the U.S. Gulf Coast is home to the only concentration of refineries in the world that can process Albertan heavy crudes. The money the Albertan government would save by not having to underwrite the rest of Canada would be gob-smacking.

Read MoreEveryone has heard of the Federal Reserve Bank or “The Fed” and that it has something to do with the value of our money — and so it must be very important. But few even claim to really understand what the Fed does and how it does it.

Read MoreThe Dow Jones Industrials Average and S&P 500 are breathing down the neck of record highs set last Fall. Some take that as a sign to sell, time to shift out of equities and realize gains. We think that would be a mistake.

Read MoreIt feels like we are living in the Land of Oz and the Fed is the "all-powerful" wizard in control.

From just about every significant group of thought leaders – the press, politicians, economists, analysts, and government officials – the narrative of the past twelve years has been all about government and nothing about the entrepreneur. They say the crisis ended because of government bailouts and easy money. It's an artificial sugar high, covering up fundamental problems that still exist and could come back without the Fed's support.

It's March 8, 2009. The market's down 56% from its all-time high, unemployment is over 8% and hurtling toward 10%, it's just been reported that real GDP dropped at a 6.2% annual rate in Q4 of 2008, and it feels like the world is coming to an end. You're tired, exhausted from living though this, and you fall into a deep sleep. So deep, in fact, that you don't wake up until today, 10 years later.

Twenty-two trillion! It's a number we have been hearing a lot lately. Five years ago, it was seventeen trillion. Sometimes as a statement, sometimes a question. Debt – consumer, business, but most notably government – has a permanent spot on many investors' minds. But knowing the level of debt hasn't helped investors. It needs to be taken in context.

Read More