Precious Metals

First Trust Economics

Brian S. Wesbury, Chief Economist

Robert Stein, Deputy Chief Economist

Date: 2/19/2026

While often grouped together, gold, silver, and copper play unique roles in the economy: gold is the focus of national reserve strategy, silver supports both investment and electronics, and copper serves as the backbone of industrial and infrastructure expansion. In 2025, each of these forces was a defining feature of the economic landscape, helping to drive outsized returns in these metals over the year. Over the past month, all three have reached historic price milestones, reinforcing the importance of understanding what lies beneath the rally. In this week’s “Three on Thursday,” we examine the structural forces behind these moves. View the three charts below to explore what is driving the surge in precious metals and what it may signal about the broader economy.

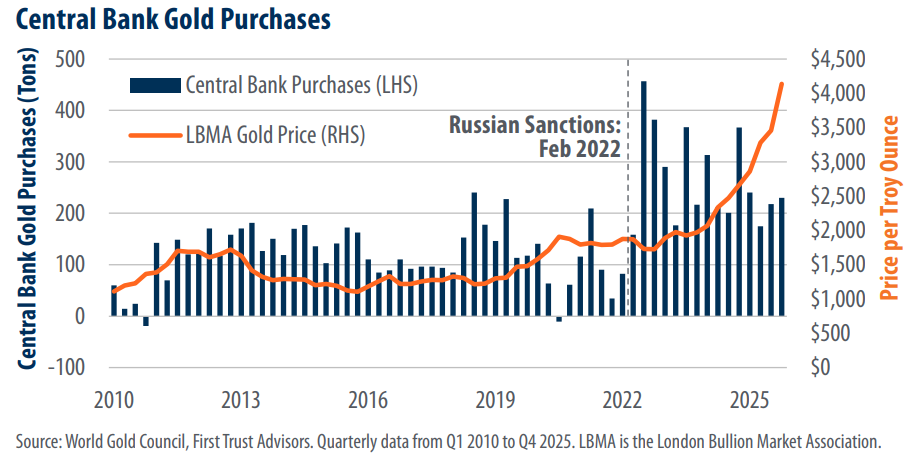

Over 60% of the demand for gold is driven by investors and central banks around the world. During times of heightened political conflict or uncertainty, central banks often turn to gold because of its universally recognized value and lack of counterparty risk. After the U.S. and its allies froze about $300 billion in Russian foreign exchange reserves following the invasion of Ukraine in 2022, many countries perceived a heightened level of risk in holding foreign exchange reserves outside their borders. As a result, central banks began to accelerate their gold purchases to insulate reserves from political conflict. More recently, major political realignments have prompted countries to keep purchasing at elevated levels to further reduce counterparty risk during political uncertainty.

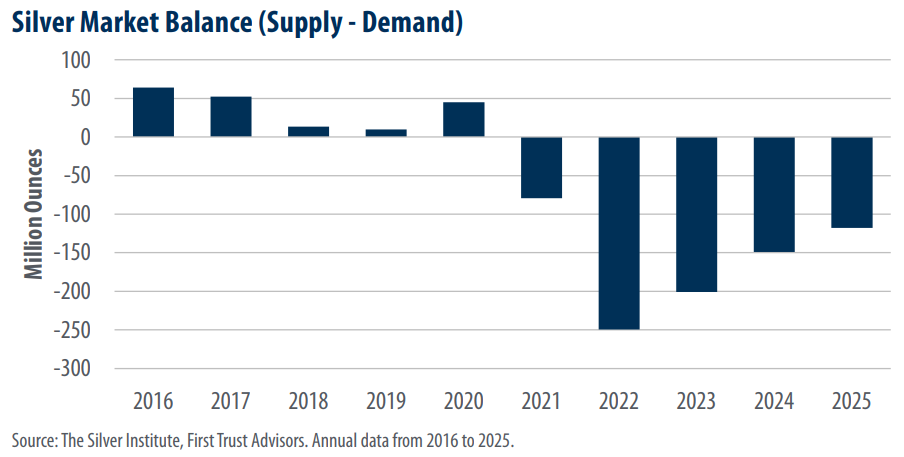

The global silver market has been undersupplied for the past five years, as industrial demand has outpaced mine production. Much of that demand has been driven by the ongoing technology buildout, particularly in advanced electronics, where silver’s superior conductivity makes it difficult to substitute. Roughly 40% of U.S. silver consumption is tied to electronics manufacturing. This growing industrial reliance is particularly significant given U.S. import dependence on the metal. In 2025, 77% of all silver consumed domestically was sourced from abroad. The U.S. silver supply chain is highly concentrated, with imports coming primarily from Mexico (47% of total imports), Canada (18%), Chile (5%), and Turkey (5%).

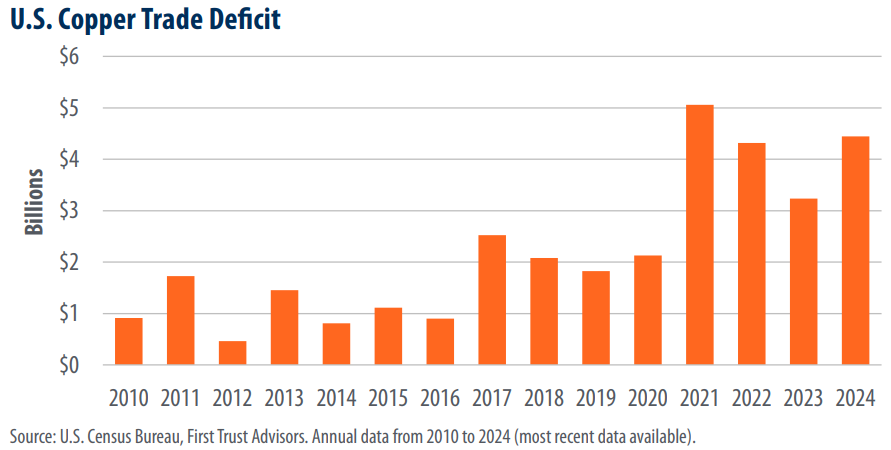

While silver is used in advanced electronics, copper is more commonly used in industrial applications. About 42% of global copper demand is from construction, with another 23% tied to electronics and electrical equipment. As large-scale technology infrastructure projects (data centers and semiconductor fabrication plants) have accelerated in recent years, domestic copper consumption has climbed, pushing U.S. import needs higher and contributing to a widening trade deficit. In 2025, 57% of copper consumed in the U.S. was imported, up from 45% in 2024. That said, about 30% of the U.S. copper supply last year was recycled from scrap, providing some buffer to international supply chains.

his report was prepared by First Trust Advisors L. P., and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

Haddonfield Financial Planning, L.L.C. (“HFP”) believes that the content provided by third parties and/or linked content is reasonably reliable and does not contain untrue statements of material fact or materially misleading information. This third-party content may be dated.