It's not possible to analyze the economy these days without focusing heavily on what government is doing. Between the Federal Reserve, fiscal policy, and COVID-related restrictions, little in our lives avoids governmental influences.

Read MoreAnother quarter for consumers to rely on massive stimulus payments, extremely loose monetary policy, and the continued re-opening of the US economy combined to push real GDP up at a very rapid pace in the second quarter, with the federal government preparing to release its initial estimate of economic growth on July 29.

Read MoreMany are convinced that a US stock market correction, or even a bear market, is inevitable. So, when the S&P 500 was down 1.6% last Thursday, many thought it had arrived. Then, the S&P 500 rebounded and hit a new all-time high on Friday. Being bearish on equities has not worked for a long time.

Read MoreWe keep hearing people make comparisons between this recovery and those of the past as if it's apples-to-apples. For example, comparing job growth today to job growth after the 2008-2009 Panic. All in an effort to make the case that government spending creates economic growth.

Read MoreIt's not a surprise. Inflation is running hot. But, is it transitory and temporary, or is it real and here for the longer term. How hot will the Federal Reserve let it run, and for how long? When does transitory and cyclical become "secular" and "serious"? These are important questions and only the Fed has the answers.

Read MoreThe Fed remains highly accommodative, there are trillions of dollars of cash on the sidelines, vaccines have reached over 50% of Americans, and the economy is expanding rapidly. Some valuations have been stretched, but the market as whole remains undervalued. As a result, we remain bullish and are lifting our targets.

Read MoreBargaining on tax hikes has already started in Washington, at least behind the scenes. It's going to be a long process, but we can say with high conviction that taxes are going up.

Read MoreThere is an old saying: When the Fed is not worried about inflation, the market should be worried.

Read MoreUnfortunately, in spite of a strong recovery in output, industrial production is 3.3% below pre-COVID levels, while real GDP is 2.5% below. In other words, demand is OK, it's supply that's still hurting – a perfect recipe for inflation.

Read MoreHerd immunity in the near future is positive news for the US economy in 2021 because it means we will be able to roll back the pandemic restrictions that remain the biggest impediment to a further economic recovery.

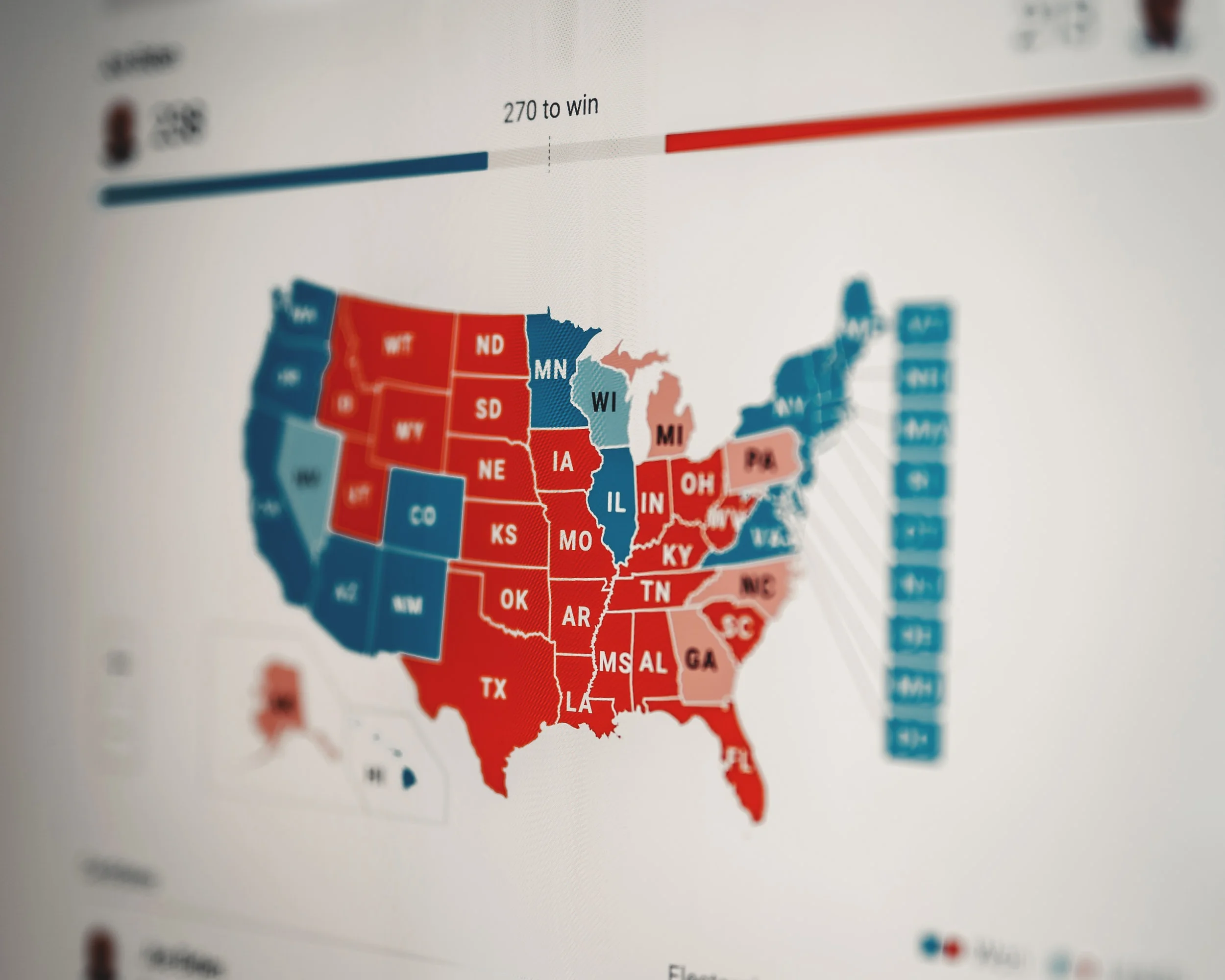

Read MoreThe seemingly endless election of 2020 is finally over, with Democrats winning both Senate seats in Georgia.

As a result, President Biden will have slender majorities in the House and Senate. These slender majorities limit many dramatic policies, which require 60 votes, but tax policy is likely to change in some significant ways.

What will happen as the economy begins to return to normal as the pandemic subsides? As restrictions on shops, bars, restaurants, travel, etc. are lifted, there will be big surge in demand for the previously restricted goods and services. At least temporarily, demand will likely exceed supply as businesspeople struggle to respond. The velocity of money will increase and over time should approach the long-term trend.

Read MoreIn the next several weeks, news headlines may be filled with dire stories. But there is light at the end of the COVID-19 tunnel, and 2021 is likely to be a much better year than 2020.

Read MoreGive Thanks! The US economy continues to heal. Payrolls keep growing, unemployment claims - though still elevated - are shrinking, key measures of the manufacturing and service sectors remain well into positive territory, and, as this week should show, both retail sales and industrial production remain on an upward trajectory.

Read More

While the election is still not certified, and court battles will drag on, it appears that we can draw two firm conclusions from the 2020 election. First, the pollsters were horribly wrong again. Secondly, American voters do not want a radical shift in economic policy.

The 2020 Election and Stocks

With the election just five days away, investors are nervous.

But allowing politics to influence investment decisions can be a big mistake.

It's true that policies matter, but America is still the home of invention.

In the near-term, it's sales and profits that still drive stocks.

Read MoreThe Presidential debate, second quarter GDP, September employment, and positive COVID tests in the White House.

What a Week! For that matter, What A Year!

Through it all, the markets are up. Who would have thought?

The signals were there if you could look through the noise. Fundamentals remain the driver.

Click here to watch the latest Wesbury 101 – What a Year! What a Week!

Follow First Trust

Twitter | LinkedIn | YouTube | Blogs